Talking Points

- The GBP/USD Declines for 4th Day

- Bearish Breakouts Begin Below 1.4090

- SSI Increases in Value to +1.83

GBP/USD 30 Minute

(Created using Marketscope 2.0 Charts)

Interested in Learning the Traits of a Successful Trader?Click HERE

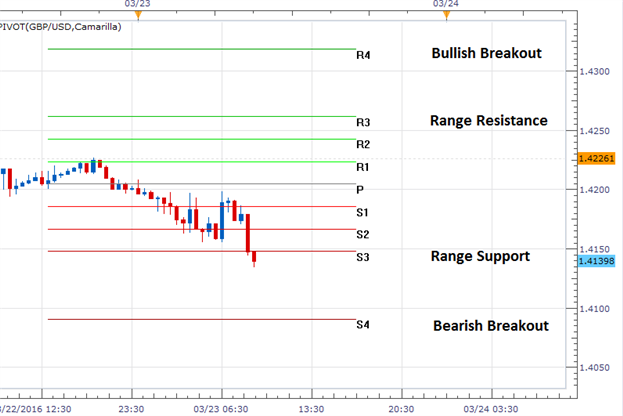

The GBP/USD has continued to decline for the fourth consecutive trading day. So far, the pair has declined as much as 93 pips, and is currently trading off the daily low at 1.4134. As price is now trading below today's S3 Camarilla pivot point at 1.4177, it opens the pair up to breakout again towards new weekly lows. Traders watching for a breakout should continue to monitor the S4 pivot point, which is found at a price of 1.4090. A move below this value would mark the third consecutive bearish breakout for the pair. In this scenario, traders may extrapolate 1X todays 127 pip trading range to find initial targets near 1.3963.

In the event of a bullish reversal, traders will first look for price action to move back inside of today's pivot range. If prices trade back above the S3 pivot, this will open up the GBP/USD to trade towards values of resistance, which include the R3 pivot point at 1.4261. In this scenario, any previously seen bearish momentum would be considered at least temporarily suspended. It should also be noted that bullish breakouts begin today above 1.4321. A move above this value would be considered significant as it would be the first bullish breakout this week, and open the GBP/USD to test new monthly highs above 1.4503.

SSI (Speculative Sentiment Index) for the GBP/USD is currently reading at +1.83. This value has increased from last week's reading of +1.37. As SSI continues to increase, when taken as a contrarian signal it suggests that there may be future price declines in store for the GBP/USD. Traders looking for a bullish reversal should continue to monitor SSI. In this scenario, traders should look for the Index to decline back towards more neutral values.

To Receive Walkers' analysis directly via email, please SIGN UP HERE

See Walker's most recent articles at hisBio Page.

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of theTraits of Successful Traders Guideto find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.